Following a bruising January, during which the Nifty 50 lost close to 1,000 points, investors are now entering the Union Budget with tempered hopes. Market watchers are increasingly of the view that a so-called “non-event Budget” – a Budget that doesn’t rock the boat – may actually turn out to be the best thing for Indian equities.

The benchmark index had a tough time in January, with risk aversion in global markets, rising bond yields, worries about stretched valuations, and outflows by foreign portfolio investors (FPIs). Against this background, the market appears to be less interested in making headlines and more interested in fiscal responsibility.

Why a ‘Non-Event Budget’ May Help Markets

Indian equity markets have, over the years, demonstrated a preference for predictability over surprises. Analysts point out that when budgets are non-event, markets tend to respond favorably in the weeks that follow.

“A predictable Budget reduces uncertainty,” said a fund manager in Mumbai. “At a time when global cues are fragile, investors want reassurance that there will be no policy surprises that could negatively impact earnings or capital flows.”

Corporate profitability is already under pressure due to slower global growth and rising input costs. A non-event budget could help stabilize markets.

Key Market Concerns Ahead of the Budget

For stocks, attention is expected to be on a few key indicators, rather than headline-grabbing promises:

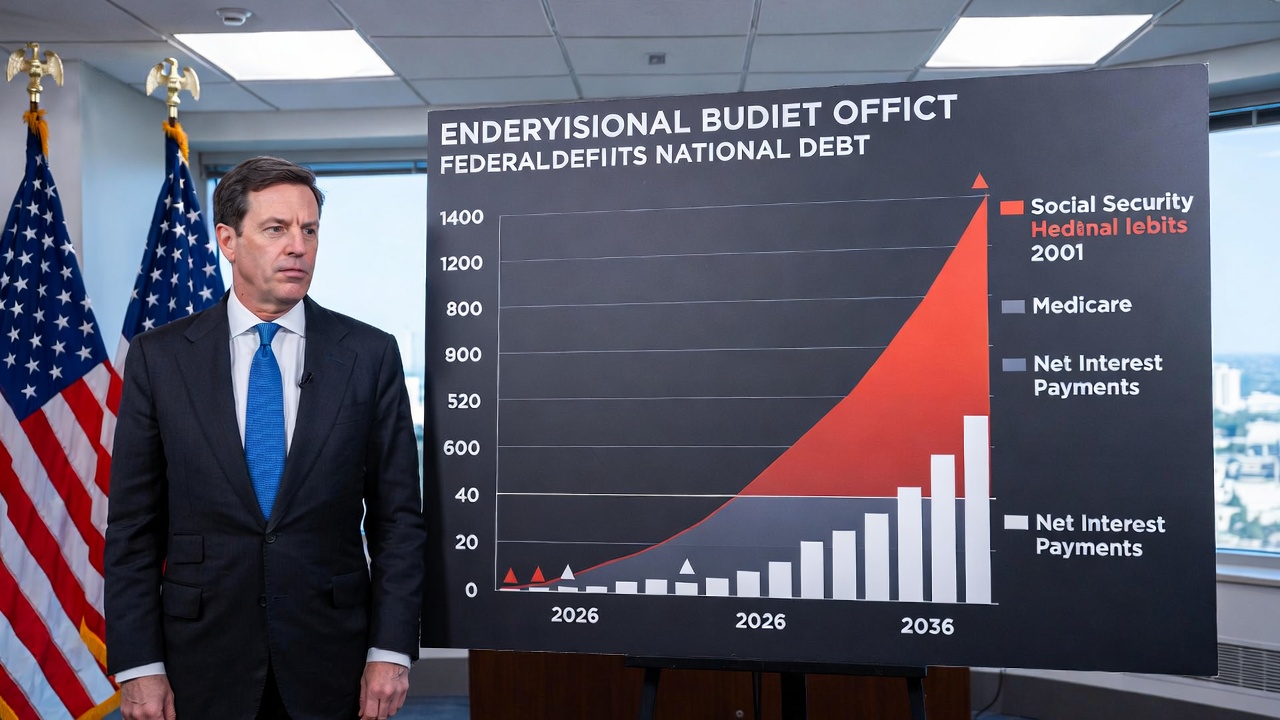

Tracking fiscal deficit targets and medium-term consolidation plans

Allocation of capital spending, especially in infrastructure and manufacturing sectors

Tax stability, especially with respect to avoiding changes in the capital gains tax or securities transaction tax

Support for consumption without overstretching the fiscal purse

Slippages in fiscal targets may further dampen market sentiment, while a status quo may encourage selective buying.

January Fall May Have Priced in Negatives

The Nifty’s sharp fall in January has already priced in a fair amount of negatives, say analysts. Valuations in some sectors, such as mid-cap IT, some financials, and capital goods, have cooled off after a long rally.

“If the Budget is more or less neutral, the downside risk may be limited,” said an equity strategist. “In that case, markets may again focus on earnings growth and overseas developments.”