The dollar has dropped to its lowest point in the past four years compared to a basket of currencies because investors are reassessing the outlook for the US economy and moving their money into higher-yielding and safer investments. Analysts believe that the dollar will continue to lose value in the coming months because of decreasing inflation, anticipated cuts in interest rates, and growing concerns about the US economy’s fiscal situation.

The dollar index (which measures the value of the dollar against six other currencies including the euro, yen, and pound) has been under constant selling pressure as the market begins to factor in a shift by the Fed. The Fed has raised rates aggressively over the last two years, but as inflation begins to cool, and data begins to show an economic slowdown, it is anticipated that the Fed will begin cutting interest rates soon.

Rate Cut Expectations Weigh on Dollar

The dollar’s slide is largely due to a reduction in the difference between interest rates in the US and those in other major economies. As US inflation continues to decrease, traders are anticipating that the Federal Reserve will begin lowering rates earlier than previously expected, which has decreased demand for dollar-denominated assets.

Meanwhile, the European and certain Asian central banks are taking a much more conservative approach to lowering rates, causing those currencies to appreciate versus the dollar. This change has resulted in a shift in the investment community’s balance of their portfolios away from dollars, adding to the dollar’s decline.

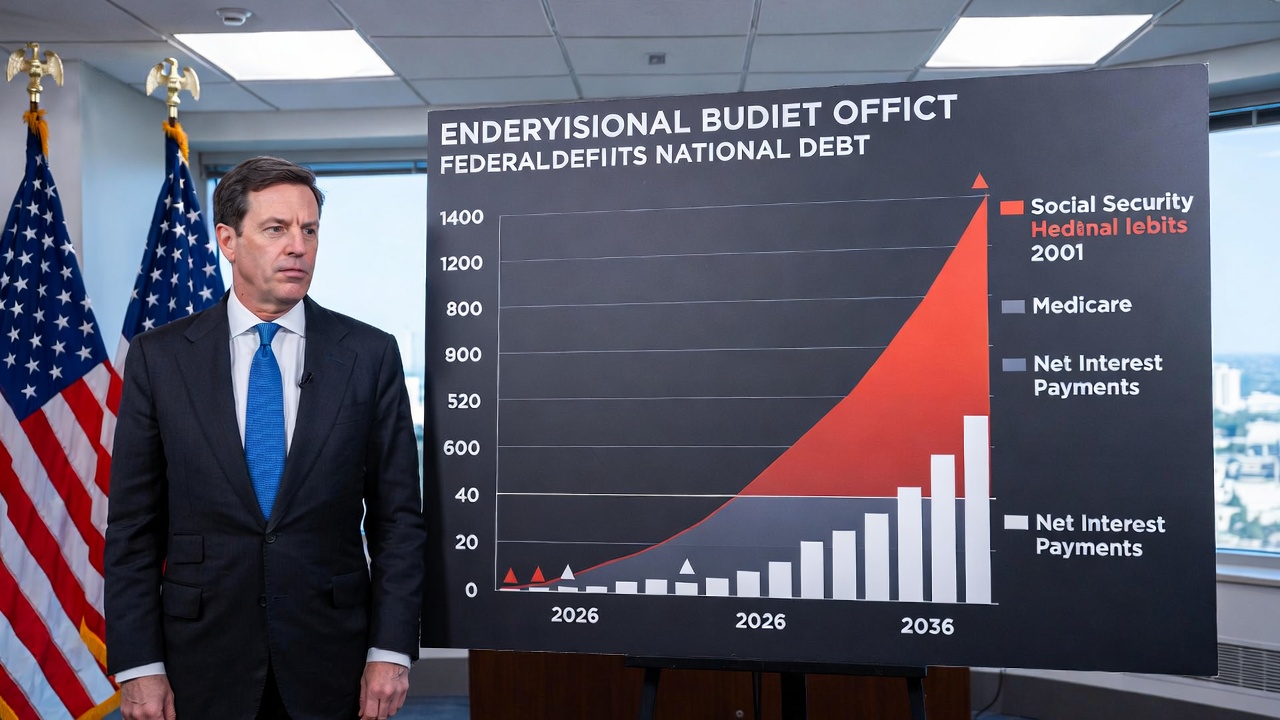

Fiscal Deficit and Debt Concerns

Concern over the US fiscal deficit has affected market confidence. Increasingly high levels of government borrowing combined with repeated budget deficiencies have caused uncertainty about the ability of the US to sustain its level of national debt. Analysts believe that this concern, among others, has made global investors less interested in holding US dollars as a store of value.

There have also been many economies in the last few months that have taken action to diversify their foreign exchange reserves away from US dollars, thus continuing the longer-term trend towards gradual de-dollarisation.

Global Risk Appetite Shifts

There has also been a strong improvement in risk appetite across global markets, which has contributed to reducing the demand for a safe haven asset like the US dollar. With fears of a significant decline in the global economy easing off, many investors have been switching into emerging market assets and more risky currencies (higher yielding), hence decreasing the US dollar’s typical appeal during periods of risk.

In addition, both the Japanese yen and the euro have gained from increased expectations of a policy return to more normal levels and better overall economic performance, therefore contributing to the downward pressure on the value of the US dollar.

Could the Dollar Fall Further?

The Currency’s Potential Decrease in Value

According to market analysts, if there is continuous weakness in US economic data and an indication from the Federal Reserve of an easing of monetary policy, this will add further downside to the dollar’s value with respect to other currencies. An increased risk of deterioration in fiscal discipline or renewed uncertainty in the US political environment could accelerate this process.

However, analysts also indicate that an increase in geopolitical tensions or a global sell-off could cause a rebound in the dollar for a brief period of time due to the dollar being the world’s reserve currency.

For the immediate future, analysts believe that there will be continued volatility of the dollar; with a lower value of the dollar as compared to other currencies, US investors will start to look outside of the US for investment returns.